With less than a week to go before the start of the new financial year, Landlords need to start planning to deal with the many tax changes coming into effect next week and that will directly affect them.

The first of the changes to the wear & tear allowance will affect every landlord with a furnished rental property.

Wear & Tear Allowances - So what are the changes?

• From 6th April 2016 the 10% allowance will be withdrawn. (In previous years, a Landlord with a furnished property could offset 10% of the gross rental income against tax. So on an annual rental income of &6000.00, a total of &600 could be off-set against tax).

• A new relief will be available for replacing furniture, furnishings, appliance and kitchenware when it has come to the end of its lifespan.

• It is not applicable for Furnished Holiday Lets and commercial property

• Integral fixtures, such as sanitary ware, fitted kitchen units are not included

• Initial cost of items will not be allowed (if the furniture is already in the property)

• Watch out for improvements - these won’t be allowable, eg. you wont be able to replace a washing machine with a washer dryer and claim for the full cost (you will need to apportion the two elements)

The governments hope is that these changes will improve the standards of living accommodation within the Private Rented Sector (PRS) by encouraging landlords to invest in replacing old and dated furniture with new.

These changes are very beneficial to HMO (Human Multiple Occupancy) and student landlords. Generally there is a higher turnover of tenants and higher wear and tear expected on all of the furnishings and portable appliances with these properties. It will also be attractive to landlords who do need to upgrade their furniture and then may be able to charge more rent in doing so as well.

The distinction between furnished and unfurnished is now no longer relevant when it comes to claiming tax relief. So a furnished professional letting landlord will probably be worse off as a result of these changes as they won’t need to replace furniture on such a frequent basis; and in turn won’t benefit from as much tax relief. This is unless they are prepared to spend 10% annually on replacing furniture. If there were no replacements made, then the property would be taxed the same as if it were unfurnished.

Stamp Duty Land Tax

Stamp Duty is the tax we pay when buying a property. The amount payable is dependent on the purchase price. From the 1st April 2016, anyone purchasing a ‘second home’ – (this could be buying your next home before you sell the one you are in, a holiday home or property investment), a 3% surcharge will apply. The window to claim this tax back has been extended to 36 months (you need to have sold the original property within this time to qualify).

For landlords moving home, this is particularly painful as even though this will be their main residence the 3% surcharge will still apply.

The current thresholds are:

Purchase price of property Rate of Stamp Duty Buy to Let/ Additional Home Rate (from 1st April 2016)

Purchase Price Current rate New Rate

&0 - &125,000 0% 3%

&125,001 - &250,000 2% 5%

&250,001 - &925,000 5% 8%

&925,001 - &1.5 million 10% 13%

What effect will this have on the Private rented sector?

It’s still too early to know for sure, however many industry leaders are concerned that BTL investors will be put off from buying any more property this year as it will directly affect the return on investment. As an example, a property in Swansea bought for &140,000 by an investor at the current rate of Stamp Duty would pay &2800.00 (2% of purchase price), but after the changes this jumps up to a whopping &7000.00.

The concern is this change will trigger a decline in the supply of available properties for let, due to less landlords investing in property this year, causing a shortage in available stock which in turn will raise rents as tenant demand rockets for quality properties.

ARLA managing director David Cox said: “The Stamp Duty changes are now imminent, and as well as hitting small landlords they will also impact institutional investors.

“Although members are reporting a rush from landlords who have been trying to snap up their buy-to-let investments, it’s likely that we’ll see the buy-to-let market drop like a stone and probably not pick up again until next year.

“This will most certainly cause rents to increase, with supply dropping, as competition for the limited availability of properties intensifies.”

www.propertyindustryeye.com

In the latest Homelet rental index, rents have risen 3.4% in the first quarter compared with last year, however Wales is still the 3rd lowest region for rents across the UK. You can view these figures in more detail here on the Homelet Rental Index page for Wales.

Tax Relief on interest payments

• Applies from 6th April 2017

• Interest no longer a fully allowable expense

• Tax relief at 20% deducted

• Introduced on a gradual basis; 25% each year starting 2016/17 and fully effective with 0% tax relief by 2020/21

The most controversial tax change so far is the government’s decision to withdraw tax relief on the interest element of mortgages for Buy To Let (BTL) investments. The government wants to make it ‘fairer’ as homeowners aren’t able to claim the relief on their home mortgages. The controversy comes as most landlords treat their property portfolio as a business and BTL mortgages are a business expense which should be tax allowable.

These changes, although will come into effect on a gradual basis, will increase the amount of tax due as tax will become payable on the total mortgage payments, rather than just the repayment element (if applicable). This could tip some lower tax rate payers into a higher tax band as their gross income will increase.

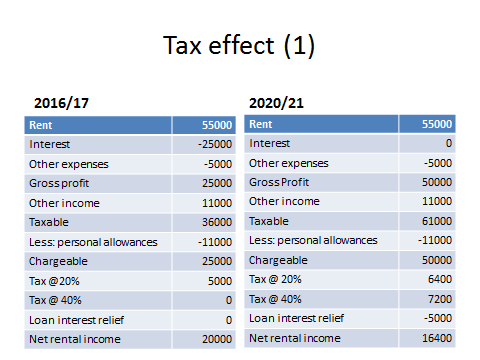

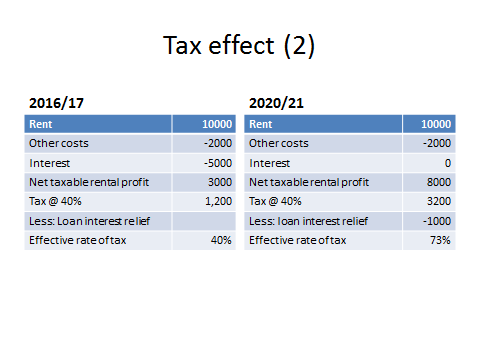

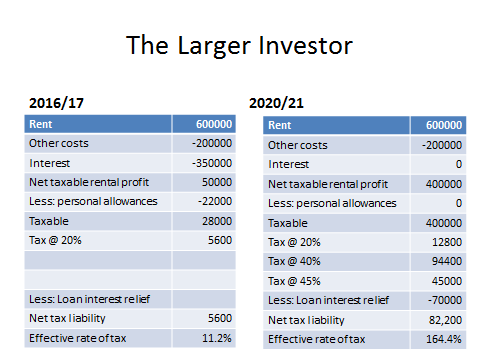

Below are some examples of how these changes could affect 3 types of property investor. The first is for a lower rate tax payer, the second a higher rate payer and the third example shows how a large investor could be affected.

* these figures do not account for the change in personal income tax changes

Our advice is anyone who is in receipt of rental income must get tax advice as soon as possible from an accountant to plan for their future tax liabilities. We recommend speaking to Morgan Hemp Accountants.

Personal Income Tax Threshold

There was some good news however in the March 2016 Budget where it was confirmed that the threshold for personal income tax would increase to &45,000 along with the higher rate. This gives some breathing space especially for the smaller landlord to avoid the mortgage interest relief removal. Those earning more than &45,000 will now be affected, up from the previous threshold of &42,000.

Capital Gains Tax changes

Whist the majority of landlords took these changes to be the final nail in the coffin for property investments, the reality is that nothing has actually changed for them when selling a property. The rates have been reduced by 8% for all levels of income, apart from residential property.